Over three months in 2021, Black entrepreneurs, capital allocators, community organizers, and researchers from the US and UK worked with the Transition Design Institute (TDI) at Carnegie Mellon University to discuss the problem of the lack of racial equity in venture funding. This research supported the work of the Venture Equity Project, a coalition of ten leading academic institutions and global nonprofits — and supported by JPMorgan Chase & Co. — aimed to permanently dismantle the barriers that exist in the flow of capital to entrepreneurs of color.

The objective of this research was to gather each stakeholder group’s perspectives, opinions, and knowledge about the problem, bridge stakeholder divides, and reveal both stakeholder agreement and opposition.

These stakeholders shared their perspectives and opinions on the problem. Those responses were aggregated and clustered into multiple ‘emergent’ themes and then broken into five societal sectors:

- Social Issues including problems related to socio-economic status, lack of access to social capital, racism & “otherness”, problematic mindsets beliefs & narratives, lack of role models & success stories, and lack of confidence in the system

- Infrastructure / Technology / Science Issues including inequitable access to education training & support, lack of or skewed data, lack of trust in infrastructural systems, and discriminatory systems & practices

- Political / Legal Issues such as the lack of representation, power & ability to influence policy, lack of trust & confidence in systems, barriers related to immigration & citizenship, lack of awareness of programs & incentives, absence of legal protection for people of color, and discriminatory laws, licensing, regulation & oversight (or lack thereof)

- Business / Economic Issues including disparity in income & advantages, discriminatory lending, evaluation & metrics, problems related to lender staffing, lack of role models, mentors & success stories, and scarcity & inequitable access to resources & assistance

- Environmental Issues

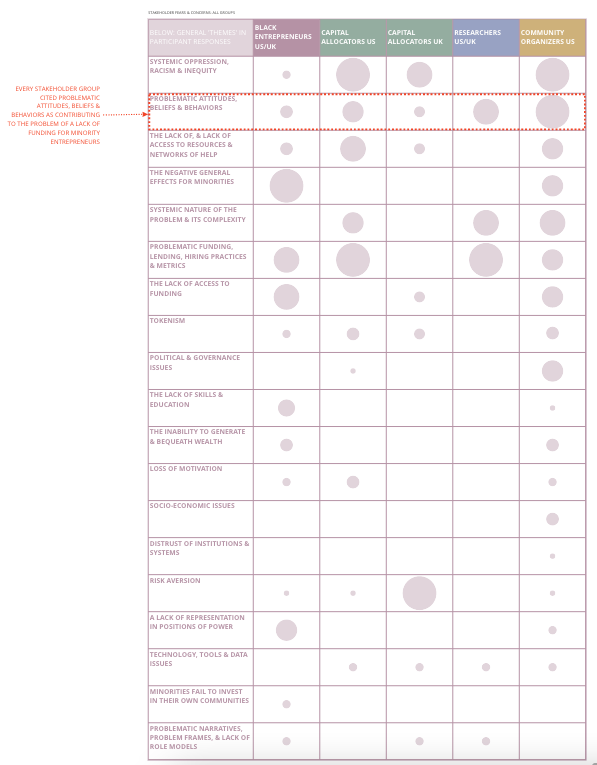

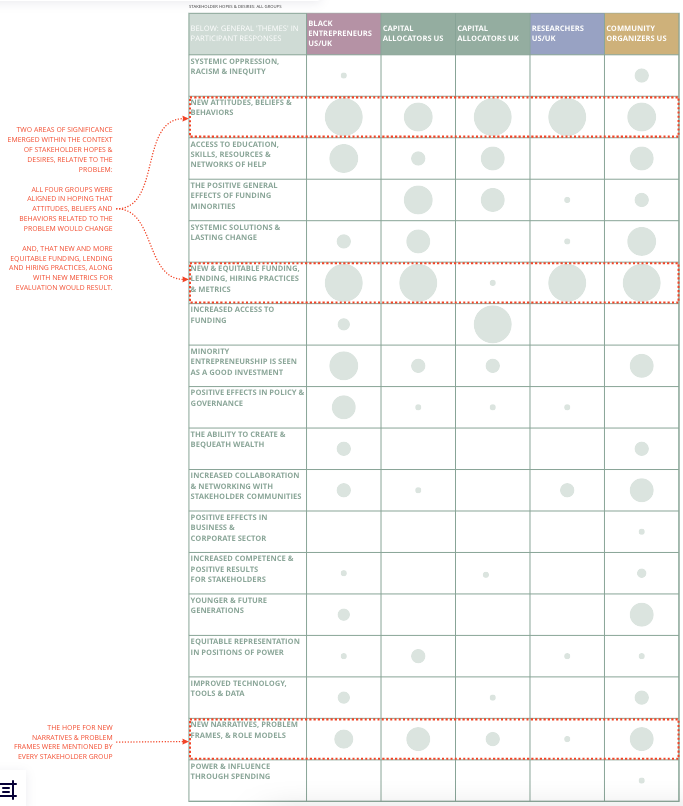

From the qualitative data gathered from the stakeholder groups, the team at TDI had the opportunity to analyze a diverse range of fears and concerns as well as hopes and desires related to the problem at hand. When looking specifically at stakeholder fears and concerns, every stakeholder group cited problematic attitudes, beliefs and behaviors as contributing to the problem of a lack of funding for entrepreneurs of color. Despite the state of the problem, all four stakeholder groups were aligned in the hope that attitudes, beliefs and behaviors related to the problem would change. All groups also hoped for equitable funding, lending, & hiring practices. Important to note is that a shift in attitudes, behavior and beliefs will need to precede meaningful change in funding, lending and hiring practices or changes in evaluation metrics, often at a scale that extends beyond the scope of this exercise as well as the Venture Equity Project as a whole. The pervasive nature of the reach of systemic racism means that systems change is required across sectors and disciplines in order to combat its many manifestations.

F2. Stakeholder Fears and Concerns

Additional analysis of this information including the top concerns and fears for each stakeholder group and direct quotes from stakeholders can be found here.

F3. Stakeholder Hopes and Desires

Additional analysis of this information including the top hopes and desires for each stakeholder group and direct quotes from stakeholders can be found here.

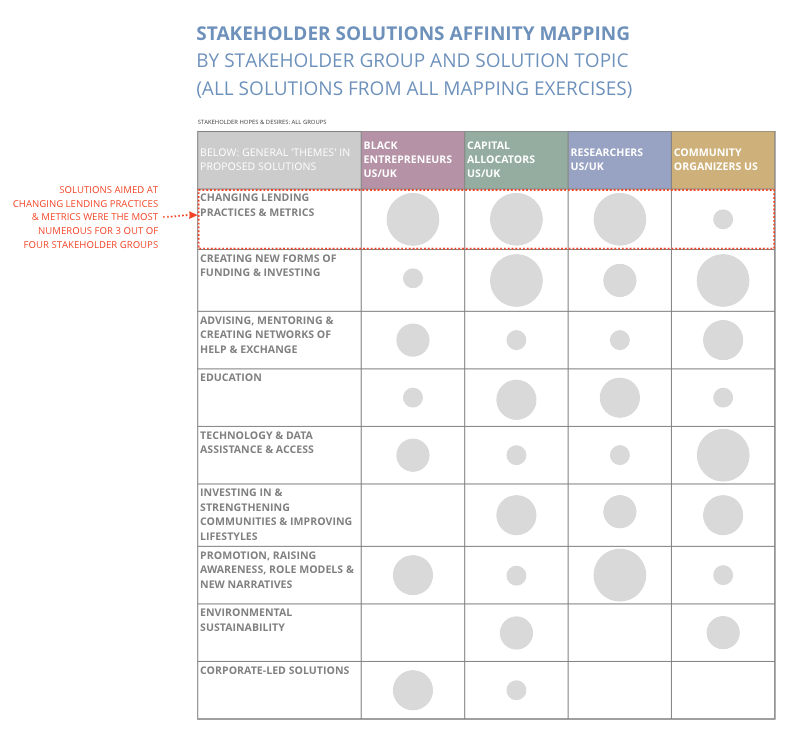

When addressing the problem, the stakeholder participants proposed solutions to eight broad categories: 1) changing lending practices & metrics, 2) creating new forms of funding/investing, 3) advising, mentoring & creating networks of help, 4) education, 5) technology & data assistance & access, 6) investing in communities & improving lifestyles, 7) promotion, raising awareness & creating new narratives, and 8) sustainability and the environment. The matrix below shows the solution categories that emerged out of the solution proposals from the four stakeholder groups. Many of these solutions map directly to the stakeholder fears/concerns and hopes/desires covered above. Solutions aimed at changing lending practices and metrics were the most numerous for the majority of stakeholders.

F.4 Stakeholder Solutions

Additional analysis of this information including direct quotes from stakeholder can be found here.

This enormous amount of information and insight represents the collective understanding of the problem and ideas about what steps could be taken to address this problem in the present, or near future. All reporting on these research findings is available in a data-rich systems map to be perused at a viewers’ own pace. This format was designed to preserve the stakeholder voice in the representation of data and analysis. Additional data, insights and short videos that focus on the key highlights and findings of the project are available here.

With this research and the research of our other partners, the Venture Equity Project aims to unlock key insights to build the first open data ecosystem that can power knowledge and access to improving first mover capital investments across the globe.

Additional Resources:

Venture Equity Project Visual Problem and Systems Map

Transition Design Institute at the Carnegie Mellon University

Invite a Friend

Close